This article is more than 1 year old

Intel: best days are ahead for servers

Xeons everywhere, virt no cause for alarm

The Itanic sails on

If you are thinking that Intel is going to abandon Itanium, you're wrong. It just isn't - no matter how embarrassing the comparisons to Nehalem-EX and then Westmere-EX and then SandyBridge-EX will get.

Skaugen said that Intel doubled Itanium performance with the quad-core Tukwila Itanium 9300s, and that it would double it again with the future Poulson Itaniums. And while he conceded that Intel had cut back on Itanium development, it did so by having the Xeon EX line share chipsets and memory buffers with Itanium. Skaugen said that Itanium customers could "invest with confidence" in Itanium machinery, and added that the Itanium line "was more profitable this year than it was last year."

While all this talk of expansion into new markets may excite Skaugen and his colleagues, the installed base of ancient servers - which Skaugen said numbers some 40 million - have them doubly excited. Although Skaugen wasn't clear whether that 40 million number was of servers or CPUs, but his talk generally referred to CPU units. A 40 million–CPU count would be consistent with the belief that there are about 25 million to 30 million true servers worldwide - not counting "desktops on their side," which Skaugen called DOTS servers, as a joke.

According to IDC estimates cited by Intel during their Westmere-EP Xeon 5600 briefings in March, 76 per cent of the x86 and x64 server installed base is comprised of machines using single-core or dual-core processors. Many of these machines are six, seven, eight, or more years old. The 2009 economic downturn pushed out the upgrading of about 1 million servers, and there are maybe 19 million to 23 million machines that need to be brought up to snuff.

Call it three year's worth of server shipments at current rates.

Now, companies can either buy the same number of servers and have a lot more performance, or they can compress a lot more computing into a smaller space. And it's hard to guess which they'll do when the spending starts. But Intel clearly believes that companies will spend, because the power and cooling issues and the increased performance that comes with getting new servers can provide a payback in a few months when you reckon software licenses and juice into the equation.

This is why the Nehalem-EP Xeon 5500 launch of March 2009 resulted in the fastest ramp of a Xeon server chip in Intel's history - and did it during a severe economic downturn. The Xeon 5500s increased from a tiny fraction of Intel's processor-shipment mix to server partners in the first quarter of 2009, ahead of their launch, rocketing in a straight line up to 90 per cent of the mix by the fourth quarter. Not only that, but customers bought faster models with more cache and clock speed, getting better bang for their buck and driving up Intel's average selling price for Xeons - along, of course, with its revenues and profits.

Another greenfield market where Intel is hoping to plop millions of Xeons is small and midrange businesses. Skaugen says there are 18 million SMBs worldwide who have lots of PCs but no servers. There are plenty of sales here to scarf up - if you can get SMBs to buy servers at all. Fifteen years of cheapo servers hasn't had a dramatic effect. Some people don't want servers, even if they need them.

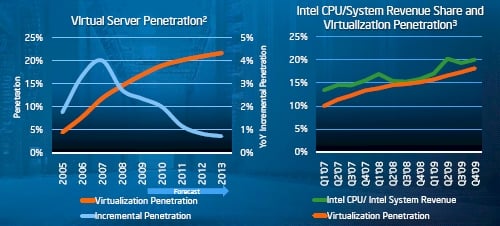

Which leaves the virtualization effect. Skaugen cited statistics from IDC that showed the penetration of virtualization on servers was slowing, and slowing dramatically. Take a gander:

As you can see, the uptake of virtualization hypervisors on new server installations is asymptotically approaching something around 24 per cent in the IDC forecast. Skaugen says that Intel believes the current number to be about 20 per cent of new machines.

The reason it won't get higher is that SMBs won't add virtualization to their entry machines - they'll buy a second server or a disaster-recovery service instead. High-performance computing clusters won't run virtualization, and it doesn't look like workstations will either, for the most part. So there are big swaths of the Xeon's addressable market that will not be virtualized. And that means unit shipments will keep forging ahead, as far as Intel is concerned.

Another reason that Intel is not scared of virtualization is that companies that are virtualizing are buying bigger processors and fatter systems, and Intel has managed to keep its share of system revenue growing more or less in synch with the penetration rate for virtualization. That suggests virtualization is not really hurting Intel. But a footprint count collapse could hurt them, if companies decide to not do a 10X or 20X compression on those vintage x86 and x64 servers with one or two cores per socket.

As far as Intel can calculate, virtualization will only knock off about 1 per cent of the compound annual growth rate projected for servers. Mercury Research stats cited by Skaugen say x64 server CPU units were about 12.5 million last year and will crest at over 20 million by 2013, with a growth rate compounded over those five years of 14 percent. ®