This article is more than 1 year old

Violin tunes up for billion dollar flash gig

Playing the big revenue game

Violin Memory CEO Don Basile reckons Violin can repeat what Connor Peripherals did in disk drives, Cisco in networking, and NetApp in file storage; become a billion dollar a year revenue platform company.

He'll do it with flash array technology because spinning disk is going to become rust, failing to keep up with the I/O demands of voracious servers. The enterprise IT buying market is beginning to share this perception because the biggest mouth in the industry backs it - Larry Ellison.

Larry Ellison's turtle speech

Basile thinks Oracle boss Larry Ellison - "the public spokesperson for the entire IT industry"- altered enterprise CIO thinking with his Turtle speech. Ellison introduced Oracle's SPARC-based SuperCluster in December 2010 and said it was a cheetah racing along at more than 30 million database transactions a minute.

A SuperCluster system, configured for a TPC-C benchmark, comprised 1,728 processor cores in 108 T3 SPARC CPUs. It had 13TB of DRAM and, something that excites Basile, 246TB of flash memory, backed up by 1.37PB of HDD array storage.

Ellison said IBM"s Power 7-based systems were like race horses, running at just 10 million transactions a minute, while HP's Itanium-based Superdome clusters were like turtles, managing just four million transactions/minute.

Basile said: "Larry is telling people to use flash … That's the fundamental shift in the industry. … Customers know their competitors will adopt the technology. Will they be first, second or last in their industry to do so? … It will happen and happen relatively quickly. It's not just speed; its the lowest cost of data base transaction in history. [Flash] is faster and cheaper on the exact same software. It's a no-brainer."

"We want to achieve a billion dollars in less than four years. It's possible."

The Ellison message, for Basile, was that the only way to keep the processor cores busy is with a great big slug of flash memory in front of the spinning disk arrays. It responds to read I/O requests in microseconds instead of the array's milliseconds, and does it without a high-end disk array's physical size, electricity needs and controller complexity. There is no way that spinning disk arrays can match NAND array performance or its far superior cost per transaction, and that's with today's 2-bit multi-level cell (MLC) NAND chips.

This is a strand of thought we have picked out from recent benchmark scores such as a TMS RamSan-630 SPC-1 result, about which we said:

There is surely no point in IBM – or any other vendor – trying to beat TMS on the SPC-1 benchmark with anything other than its own flash-based system.

Basile is convinced that CIOs now understand that they have to have database and other transaction processing systems in the future which use clustered processors and back-end bulk data tub drive arrays with front-end flash arrays to hold the dynamic data, the working set data. This is a theme coming out of the high-performance computing and big data area also, witness an Intel presentation at ISC in Hamburg.

However, it is the case that general and widespread use of front-end flash arrays won't happen unless flash costs go down. Basile thinks that stopper is going to be cancelled out and a tipping point reached as flash arrays cross the chasm into mainstream deployment. The technology that will make this happen is 3-bit MLC.

Three bit MLC

With three bits per cell 3-bit MLC NAND should be 50 per cent cheaper than 2-bit MLC per GB. But there is a drawback; 3-bit MLC has a shorter working life than 2-bit MLC and flash controllers using it have to get around this with more complicated wear-levelling schemes, error-checking-and-correction (ECC) logic and so forth. It is non-trivial.

Violin seems confident it can pull this off and deliver 3-bit MLC arrays: "We see 3-bit MLC coming in, early next year, in volume by summer. The amount of error correction required is greater than 2-bit… needing 100-bit, even multi-100-bit ECC corrections. To do this at speed is not easy."

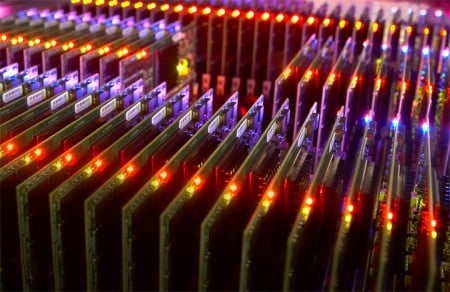

Flash cards in Violin Memory array enclosure.

He is confident it can be done and says: "The economic impact is that we'll be down to $2/GB level pricing."

Today's flash pricing sees Violin list pricing MLC at the $20/GB area and transacting orders in the mid-single digits. SLC flash product lists $30/GB and transactions take place in the teens. If Violin can transact 3-bit MLC flash product orders at $2/GB the financial logic is compelling - as long as volume sales result.

If this happens and volume flash array, and SSD, sales take off then ensuring NAND chip supplies will become paramount.

NAND chip supply security

Roughly speaking Samsung and Toshiba have 80-90 per cent of NAND flash fabrication volume with IMFT (Intel Micron Flash Technologies) having the rest. We are NAND supply-constrained. Fabs cost $10bn plus and there aren't enough of them even to begin replacing the spinning disk industry even if NAND was as affordable as disk.

Basile said: "We made our deal to make Toshiba our largest investor and strategic partner - so we will get our NAND. Steve Jobs will get his NAND and we will too."

If NAND prices do come down with 3-bit MLC then demand will jump and supply constraints occur. If that happens then having security of supply for a NAND-based product supplier will enable them to continue uninterrupted production and not suffer price spikes. SSD and flash array suppliers buying NAND on the spot market will have to pay higher prices and be disadvantaged.

What existing NAND supply arrangements exist?

Toshiba has invested in Violin Memory and has a strategic partner relationship. SanDisk partners Toshiba in the fab business and has bought Pliant to get into the enterprise SSD business.

Basile said: "SanDisk bought Pliant because the enterprise space is really big. It became a new entrant in a growth market. They should probably buy another couple of companies if they want to be taken seriously, getting software and network expertise."

Samsung has invested in Fusion-io and has a relationship with Seagate for SSDs.

Micron makes PCIe format flash cards and SSDs. Intel makes SSDs, has a relationship with Hitachi GST to make additional SSD product, and will likely enter the PCIe flash business. Western Digital is buying Hitachi GST and should inherit the Intel relationship.

NAND product suppliers such as OCZ, STEC, and Texas Memory Systems, buy on the NAND spot market.

Basile said: "We made our deal to make Toshiba our largest investor and strategic partner - so we will get our NAND. Steve Jobs will get his NAND and we will too."

Violin Memory CEO Don Basile

"In a high-demand market prices spike up, not down, and it's complex to hedge… NAND is the fuel of the industry. if prices go up and you have no partner, you have a spike risk. Steve Jobs has his NAND fuel; he's hedged. You take a 20 per cent NAND price hit and if you're OCZ you're in negative margins."

If there are supply shortages then spot market NAND buyers may not be able to fulfill contracted delivery obligations. Basile thinks this means: "a lot of risk to the business model … we've mitigated the risk."

Over time, as NAND dies get smaller they are less and less interchangeable. Merchant NAND buyers will then find harder to leverage the spot market.

So suppliers like OCZ, STEC and TMS share a vulnerability, and this is "a huge risk for them" according to Basile.