This article is more than 1 year old

Acronis reveals plan to bust out of backup biz, thrust growth sideways

Plenty of room in enterprise sync 'n' share, right?

Acronis is making a break-out move from the data protection business, looking to expand sideways into file access, synch 'n share. Why is it doing this?

Competing in the backup market is a bit like trench warfare. There's a lot of hunkering down, lots of noise and smoke but nothing much changes overall because the proprietary software vendors know their game well enough, are quick enough to respond to things like virtual servers, and are too well-entrenched to be dislodged from customers.

There are no great growth opportunities in backup software, which is why Acronis's break-out move is significant. It's adding an enterprise file sharing and synchronisation product to its portfolio because it sees a significant growth opportunity there. it's essentially building a "Dropbox for business" kind of product, and one which will net it new customers to whom it can cross-sell backup products, while it can also sell file sync 'n' share to its existing backup customers.

That's the calculation of new CEO Alex Pinchev, who joined Acronis from Red Hat sales, and recruited another Red Hatter, Scott Crenshaw, to be Acronis chief marketing officer. Under Pinchev's leadership, the company also bought GroupLogic and its enterprise file access, share and synchronisation technology – background here.

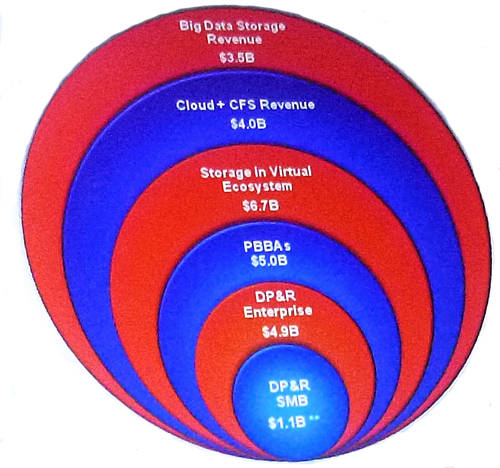

El Reg talked to David Blackman, Acronis's general manager for the UK and Nordic countries, at VMWorld in Barcelona about what's happening. Blackman said to understand the firm's latest moves, one needs to consider "TAM" (Total Addressable Market) circles and data movement to the cloud. He showed us what he meant with a notebook computer presentation, and we snapped a shot of the TAM circles screen:

Acronis TAM circles

The idea is that the small/medium business data protection and recovery market is a $1.1bn addressable market. Enterprise data protection is a $4.9bn one, making a $6bn TAM. Blackman said that enterprise file synch 'n' share is another $5bn market, making a total TAM of $11bn for Acronis. This appears to be part of the Storage in Virtual Ecosystem and Cloud + CFS Revenue circles. You can see PBBAs on the slide – these are purpose-built backup appliances by the way.

Blackman said: "We are not walking away from the data protection market," this being an additive exercise. The popularity of Dropbox has shown the need to be able to access a synchronised set of files across a set of user devices, from smartphone, through tablet and notebook to desktop PC, but, he adds: "Dropbox is not secure."

Acronis has its FlashBack technology in the vmProtect 8.0 product. It provides a form of incremental restore based on changed block tracking. When a virtual machine (VM) is restored, only the changed blocks are transferred from the backup and added to the original VM, thus speeding up restore. This is going to be used in Acronis's file synchronisation and access technology to minimise bandwidth and speed access and synchronisation. Deduplication should also be used to prevent duplicated data being sent back and forth.

The GroupLogic acquisition bought 7,000-plus customers with it, including The Financial Times and Condé Nast, which has a lot of Macs, giving Acronis an 'in' to the Mac world. Blackman said GroupLogic people think file access from IOS and Android devices "will be everywhere" soon enough, and Acronis will support Windows and Linux users too.

It wants to move VMs from on-premise to an Acronis cloud, then to the Amazon cloud and then any cloud.

Acronis reckons it has more than a quarter of a million corporate customers now, an excellent base into which file access, synchronisation and sharing products can be introduced – along with the same geographical spread and local language features enjoyed by its backup products. It has a data protection product infrastructure; 14 local languages; offices in 18 countries; 25,000 partners selling into 90-plus countries – all of thiscan be used to launch the coming file access, synch 'n share products.

We don't know their names, but the products will probably be revealed in the next few months. They will be based on GroupLogic's activEcho enterprise file sharing, mobilEcho mobile file management, ExtremeZ-IP Mac, Windows and NAS integration, and, maybe, MassTransit file transfer product and ArchiveConnect Mac/Windows archiving technologies.

Blackman points out: "Acronis is now larger than when Alex joined Red Hat," as if to say: "Look how much we can grow."

Pinchev is a man in a hurry and the Acronis organisation is going to be pushed hard as he tries to replicate Red Hat levels of sales growth.

Other data protection software companies take note: you are in the same situation as Acronis, stuck in a slow- or no-growth business. What else might your infrastructure be used for that could complement your data protection products and grow your business? ®