This article is more than 1 year old

Cashing it in: Personal finance apps – the best and the rest

Money spinners and money savers

Review Greater individual control over personal finance is booming, with the British Bankers Association (BBA) reporting 5.7 million transactions a day are now made from smartphones. This is transformational stuff, but it’s not all about current account apps. Personal finance guru Jennifer Newton follows the money and finds the best apps for creative accounting.

There are thousands of money apps available on all platforms, but few are worth installing if not used regularly. Apps worthy of phone space should have practical functions and essentially simplify performing calculations or transactions and will produce results in a few taps and swipes.

Although, fiscal junkies may argue the case for apps like Moneywiz – which sort all finances in one place, which Americans typically love – there are plenty of free or low cost alternatives that provide quick and easy calculations. The best of these financial operators have a unique "wow factor", so here we have some for the sums and then some.

Loan Calculator – What If

Originally called carloans4u, many needing a general debt interest calculator will have passed this one by. However, it was one of the first and is still the easiest for quickly calculating how much a loan costs, whether a mortgage, personal loan or student loan. It might not sound especially exciting, but as soon as you start getting to grips with the interest-to-principal ratio payoff, you can better understand how a loan can be managed.

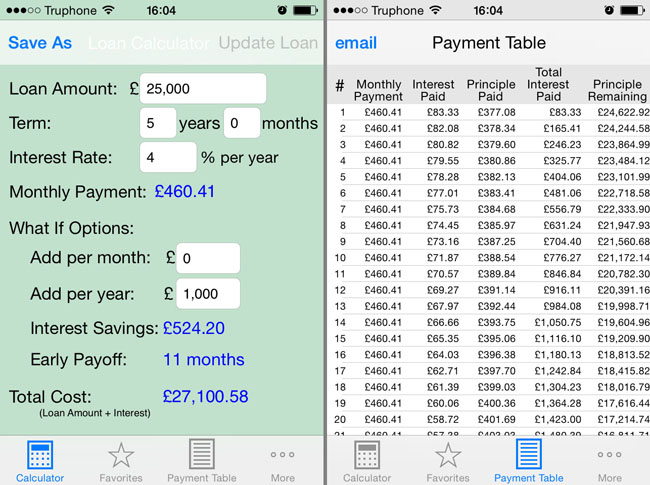

From inputting the amount to borrow, the interest rate and how many years to repay, the monthly payments are calculated. Then flick over to the payment table, which in easy graph form shows month-by-month how much interest is paid, the principal and total amount left owing.

Any loan can be calculated and the repayment intervals scrutinised

The wow factor comes from the "What If" options field. This feature calculates how additional payments will help pay off the loan earlier with extra payments either monthly or annually. So, if you were considering a personal loan of £25,000, taken for a term of five years with an interest rate of 4 per cent, the monthly payment will be £460, total cost £27,624.78 shown on app.

Using the What If option and adding a £1,000 top-up payment each year, quickly shows you’ll save £524.20 in interest charges with the loan paid off 11 months earlier and overall amount paid reduced to £27,100.58. It really starts you thinking and experimenting with how even modest additions can diminish the cost and the repayment period of loan.

Finally, if doing a search for cheapest loans on an aggregate comparison site, all the different payment tables calculated on the app can be saved and retrieved under the Favourites button. Admittedly, this is iOS only but it's a good example of features to look for if you're searching for apps on other platforms.

Price 69p

More info Loan Calculator – What If?