This article is more than 1 year old

Woah there Dot Hill, that's one seriously fat sales boom

SAN bods knock five year slump on the head

A five year slump is over and high-end SAN maker Dot Hill is back after posting monster fourth-quarter revenues. Full year revenues still have a way to go, though, before the firm beats its 2010 high point.

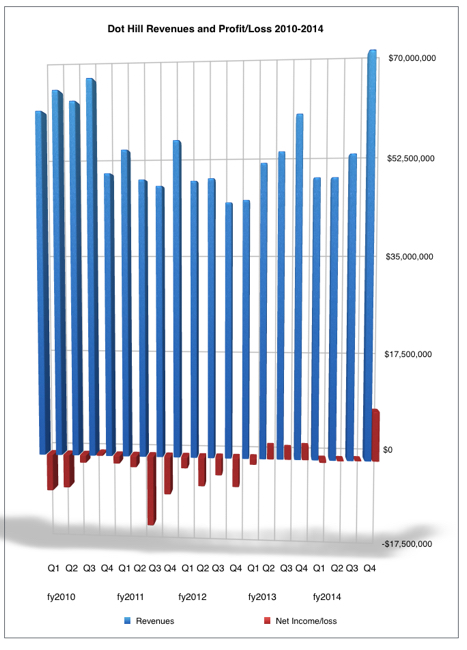

$69.1m was the revenue number for the fourth 2014 quarter, 17.5 per cent up on the $58.8m recorded a year ago, and 5.6 per cent higher the Q4 2010’s $65.4m. The chart shows the great five year-long slump between these two numbers.

Vertical 3D chart depicting Dot Hill's descent into – and climb out of – a multi-year revenue slump.

This latest quarter was a huge jump on the third quarter’s $52.1m, a 32.6 per cent increase. Dot Hill CEO and president Dana Kammersgard said: "Last quarter, we talked about chasing supply, and [this quarter] we were successful in fulfilling all of our customers' ramp demands."

The full year numbers weren’t so impressive, with one dashing quarter not making up for three more pedestrian ones. Net revenue was $217.7m, steadily up on last year's $206.6m – a 5.4 per cent increase – but a long way short of 2010’s $252.5m. Still, it’s the second full year of revenue growth.

The profit picture is splendid: Dot Hill reported $8.5m for the fourth quarter, 59 per cent higher than a year ago and a standout contrast to last quarter’s measly $40,000.

Whence came this fourth quarter financial success? Kammersgard sounded surprisingly low-key and restrained in his canned quote: “The fourth quarter was perhaps the first real financial evidence of the company-specific growth catalysts that we have been working on for quite some time. We added new customers and introduced breakthrough solutions to existing customers through product launches that we have been intently focused on throughout the year."

It's been a long hard grind with new product technologies and new OEM outlets to wrangle with. Dot Hill sells disk drive arrays to server OEMs (HP, Lenovo, Stratus, Dell and AMD), and vertical market partners (Teradata, Motorola, Tektronix, Concurrent, Autodesk, Nokia Siemens) selling into Media and Entertainment, Telecommunications Infrastructure, Oil and Gas, Big Data Analytics, Digital Imaging and other markets.

The future looks bright too, with CFO Hanif Jamal saying: "We believe that we have set ourselves up well for strong revenue growth and our fourth quarter results were the first tangible data point indicative of significant new revenue streams." He also expects "EPS growth at a much faster rate than revenue growth."

EPS (Earnings per Share) is reflective of profits and so Dot Hill is set for a rewarding 2015. Maybe it will surpass 2010? It's a big ask but if the momentum of this fourth quarter can be maintained ... ®