This article is more than 1 year old

QLogic escapes HBA flat trap with Ethernet and add-on services

Farewell to HBA twin Emulex too; away we go to Avago

Storage networking adaptor times are changing

There is, QLogic told analysts, a ramping storage target opportunity. In all-flash arrays it has a greater than 90 per cent share of Fibre Channel connectivity.

The 10/25/50/100GbitE TAM (total addressable market) is growing from $800m today to $2.0 Bn by 2018. QLogic's initial 25/50/100GbitE (single ASIC) products should ship in 2016.

Rampalli reckons the company can expand its "current addressable market from $1.5bn today to $7 billion over the next few years; driving revenue from $520.2m in fiscal 2015 ... to $700m over the next 3-4 years."

The company bought Broadcom's NX2 technology and says it has 32 Ethernet product design wins with the Intel Grantley cycle. Rakers says it claims "a share increase in Ethernet connectivity – increasing from four per cent share in calendar Q1, financial year 2014, to 26 per cent share in C4Q14. The company also continues to highlight a time-to-market leadership positioning in 25/50/100GbitE." It also says it leads in converged network adapters (Fibre Channel over Ethernet).

Overall QLogic sees Moore's Law decelerating with regard to CPU performance and storage density increasing, as seen with flash arrays. Here's what Rakers said on this front:

QLogic believes the architectural attributes playing out in the data centre will increasingly require CPU offloading, and thus in QLogic’s case, the need of intelligent/software-enabled I/O solution.

HP has become the first strategic customer embracing this QLogic concept.

QLogic sees new possibilities in the cloud market with "traditional enterprises, SI/telcos/hosting (Managed Service Providers – Atos, Terremark, AT&T, Savvis, Rackspace, and BT Group), IaaS / PaaS / SaaS (cloud SPs – AWS, Salesforce.com, NetSuite, Windows Azure, Tencent, etc.; based on commodity hardware), and megadata centres (consumer web – Facebook, Apple, Baidu, Google, Alibaba, Yahoo, etc.)"

It has collaborated with Cavium to combine its 25GbitE RDMA-enabled NICs (RNICs) with Cavium's ARM-based 48 core ThunderX processors optimised for cloud compute workloads and multi-petabytes of networked storage server nodes. The two suppliers their bundle allows separate performance and capacity scaling. It "significantly accelerates performance of enterprise storage, cloud storage and big data storage applications such as Ceph and Hadoop.

QLogic says it will look to establish more strategic partnership similar to this Cavium one.

Roadmap

For Fibre Channel QLogic will focus on:

- End-to-end fabric intelligence (e.g., orchestration and virtualisation; note: partnership with Brocade)

- Standardisation for Flash-based SAN infrastructure (NVM Fabrics; NVMf) – enabling the network infrastructure to recognise the implementation/usage of Flash

- A drive to 128Gbit/s Fibre Channel

Rakers noted: "The company plans on providing a programmable engine on top of its traditional I/O connectivity solutions for programmable services such as security, dedupe, compression, and the ability to create user defined services."

QLogic said it had won "its first order for new I/O replication solution this week from a tier-1 storage OEM; expected to ship in every one of this vendor’s storage solutions in the second half of financial year 2015. Using this I/O replication offload capability, QLogic notes that this storage vendor saw a 40 per cent improvement in storage performance."

It says it will promote the use of its tri-mode 25/50/100 GbitE ASIC technology and also move into software-defined networking as it relates to storage.

QLogic aims to add more intelligence to its connectivity products with features such as replication/mirroring, deduplication, compression and encryption, which can all be done in-line. A top rank OEM is expected to be evaluating these offerings by the end of the year.

Channel-wise QLogic wants "to expand its OEM base from the traditional systems vendors (EMC, HP, NetApp, etc.) to names such as AT&T, Rackspace, Synnex, Quanta Computer, SuperMicro, as well as expanding its current base of +300 channel partners."

QLogic and Emulex

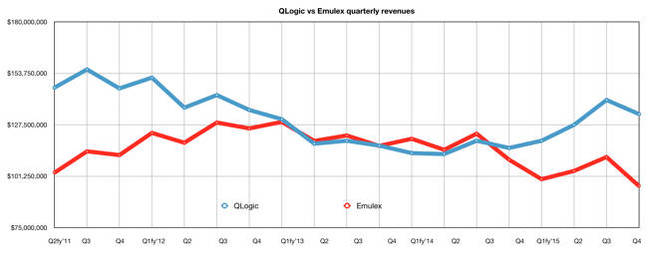

How did QLogic do compared to fellow storage networking adaptor vendor Emulex in the latest quarter?

The short answer is very well indeed, with the revenue gap widening in QLogic's favour. This is probably the last quarter we'll be able to make this comparison as Emulex is being bought by Avago and its results may no longer be broken out. So QLogic will no longer be able to kick that dog and smile at the way Emulex's original revenue lead has been eaten away in a symmetrical pair of curves in the chart above.

All-in-all, QLogic president and CEO Prasad Rampalli can feel he's done a good job compared to the one done by his predecessor Simon Biddiscombe who quit two years ago. Since then its Fibre Channel switch business has been ditched and QLogic's guiding light HK Desai passed on.

Forget the old HBA stability and the threat to it from FCoE. Now its CPU-offload and in-line data reduction and availability/security services The storage networking adaptor times really are a-changing. ®