This article is more than 1 year old

Imation flogs off IronKey to Kingston

Gets NYSE listing compliance notice

Imation has unravelled one of ex-CEO Mark Lucas's recovery strategy acquisitions and sold the IronKey business to Kingston. It's also received a non-compliance listing notice from the New York Stock Exchange; its valuation not being high enough.

Lucas bought IronKey and its secure flash drive hardware as part of a diversification strategy away from the declining tape and optical media businesses. It was not successful.

Now, with activist investors in control at Imation and Lucas history, Imation is focussing on its Nexsan storage array and Connected Data private cloud sync and share technologies.

There's no place for IronKey and it's gone, the USB technology and the assets, to the Kingston Digital business unit inside the Kingston Technology Company, Inc.

No price has been mentioned.

Kingston will integrate IronKey with its DataTraveler encrypted USB drive products. There will be an integration process and, during this, Kingston wants to assure all parties that there will be no immediate changes to the way business is transacted by channel partners currently supporting IronKey products.

Encryption services supplier DataLocker has bought the IronKey Enterprise Management Services (EMS) platform, which provides centralized management to encrypted USB drives. DataLocker has previously acquired the SafeConsole management system from BlockMaster, the system that Kingston uses on its current encrypted USB flash drives.

Valentina Vitolo, Kingston's flash business manager, said; "Having ... DataLocker manage both the EMS and SafeConsole platforms is a win for all of our combined customers."

Listing notice

The NYSE has a requirement for a $50 million capitalization minimum over a consecutive 30 trading-day period and for stockholders' equity being more than $50 million for listed stocks. If a stock falls below these minimums then the NYSE sends a formal non-compliance notice letter and the company issuing the stock has 45 days to provide a plan with definitive action that would return it to compliance within 18 months of receipt of the notice.

A non-compliance notice letter has been sent to Imation.

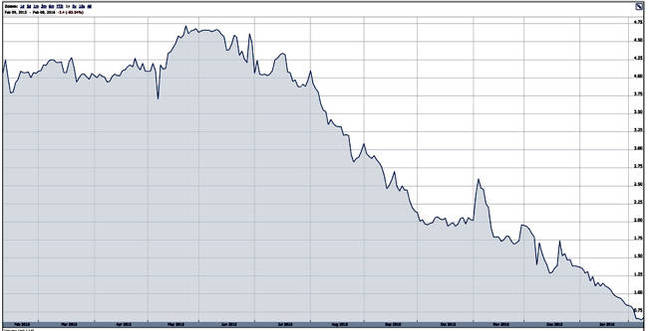

Here's a chart showing its stock price over the last 12 months:

It's a disaster zone for investors, showing a profile akin to a downhill ski-run. Imation stock peaked at $4.72 on May 21, 2015,and is now $0.675, with Imation capitalised at $24.09m. That's 85.2 per cent of its value lost in a little over eight months.

The Clinton Group took control of Imation in May 2015, when the then-CEO Mark Lucas was voted off the board for value-destruction. It won the board chairmanship in August of that year.

Investors in general have no faith in how the Clinton Group is running things, according to the stock price chart, which shows continued value-destruction.

The board somehow has to get Imation's market capitalization up to NYSE minimums, take the company private, or find a buyer in a market where the on-premises bones of legacy dual-controller arrays are being fiercely fought over by all-flash array startups and revitalized incumbents, hybrid flash-disk array newcomers and hyper-converged offerings.

Basically Nexsan needs a boatload of development to have a prayer of competing successfully against, pause for deep breath; Dell, EMC, HDS, HPE, IBM, Kaminario, NetApp, Nimble, Nutanix, Pivot3/NexGen, Pure Storage, Simplivity, Tegile, Tintri, Uncle Tom Cobley, X-IO and all. The chances of Nexsan emerging successfully from such a scrap must surely be low.

If Imation goes private then the Clinton Group would probably need to do a deal with a private equity house. If it is sold, then the stock price debacle suggests a fire sale could be all the Clinton Group could hope for.

It will take some kind of miracle for Imation to survive all this. ®