This article is more than 1 year old

Who hit you, HP Inc? 'Windows 10! It's all Windows 10's fault'

PC and printer biz CEO blames Microsoft's operating system for dismal first quarter

HP Ink – the PC and printers half of the Hewlett-Packard split – has blamed Windows 10 for a ho-hum quarter of declining sales.

"Windows 10 is a tremendous operating system platform," HP Ink CEO Dion Weisler told analysts and investors on a conference call on Wednesday afternoon. "But we have not yet seen the anticipated Win10 stimulation of demand that we would hope for."

Weisler was speaking about an hour after his company published the financial figures [PDF] for the first three months of its fiscal 2016 year. It's HP Ink's first quarter as a standalone company since the Great HP Split of 2015.

We were told Microsoft's software hasn't, so far, apparently, spurred enough people into buying HP-branded PCs. Well, that may explain the 13 per cent fall in the company's personal systems revenues. But how about its printers, though? People love printers, right? Always buying them. Always having fun on cold Sunday evenings reinstalling drivers. Unjamming the paper trays. Buying new cartridges. Revenues fell 17 per cent. Ah.

This should have been a boom quarter for HP Ink as the period covered the Christmas shopping season. Instead, it was lackluster. Here's a summary of the three months to January 31:

- Net revenue was down 12 per cent year-on-year to $12.2bn (£8.76bn).

- The Americas took in 46 per cent of net revenue, EMEA brought in 34 per cent, and Asia-Pacific-Japan made up 20 per cent.

- Net earnings came to $592m (£425m), down 56 per cent on the year-ago period.

- Diluted net earnings per share was $0.33, less than half of Q1 2015's $0.73 but within its Q1 2016 guidance.

- Just over $1bn was returned to shareholders via share repurchases and dividends.

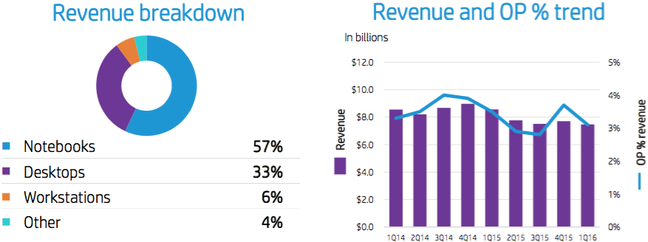

- In the Personal Systems division:

- Notebooks brought in $4.2bn in revenues, down 11 per cent year-on-year.

- Desktops booked $2.5bn in revenues, down 14 per cent.

- Workstations took $444m in sales, down 16 per cent.

- Other revenues from the unit totaled $291m, down 20 per cent.

- If you take exchange-rate fluctuations into account, the Personal Systems division was down six per cent in revenues, or 13 per cent if not.

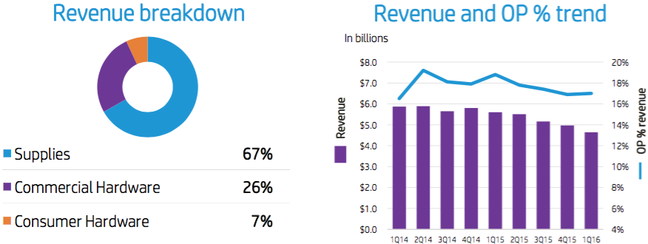

- In the Printing division:

- Sales of supplies brought in $3.1bn, down 14 per cent year-on-year.

- Commercial hardware took in $1.2bn in revenues, down 13 per cent.

- Consumer hardware booked $322m, down 46 per cent.

- If you take exchange-rate fluctuations into account, the Printing unit was down 11 per cent in revenues, or 17 per cent if not.

So currency swings, the free giveaway of Windows 10 (normally people buy a new machine to get a new Microsoft OS), and the fact that no one uses printers any more is punishing a company primarily relying on printer and PC sales.

"In the back half of this year, revenue will begin to improve as our technology improves and channel inventory works its way out of the system," Weisler continued.

"Our PC lines are being redrawn at the moment, and the goal has been to gain profitable [market] share," he added, meaning that HP Ink is only chasing product areas where it knows it can turn a profit. Now that's the kind of thinking that earns you an MBA.

"We will continue to take costs out of the system, and drive innovation into the system," he said. The chief exec also referred to "accelerated restructuring," which means the 3,000 or so staff due to be axed over the next three years will lose their jobs by the end of 2016, well ahead of schedule.

"PC declines will moderate over the course of the year," CFO Cathie Lesjak tried to reassure investors, adding: "We do need some channel inventory correction in Q2."

HP Inc's Q1 2016 Personal Systems

OP% = operating profit as a percentage of revenue (click to enlarge)

HP Ink's stock price closed at $10.81, up 4.85 per cent on the day, and then fell 1.39 per cent in after-hours trading when the financial results were published.

The company's forecast profit for the next quarter – between 35 and 40 cents a share – matched guesstimates by analysts. Investors have been urged to stick around and wait for the year to pan out as the PC business may actually improve while costs are cut hard and fast.

“It’s all bad,” said tech analyst Anand Srinivasan, which is perhaps the most upbeat thing you can say right now about HP Ink. ®