This article is more than 1 year old

Toshiba storage keeps eye on flash as Group sheds jobs, sells divisions

Post-accounting scandal growth plan birthed

Toshiba is doubling down on flash memory as a revenue growth engine to help climb out of the financial poo, while also aiming to get dollars spinning out of its disk drive business.

In a reconstruction plan revealed on Friday, the troubled Japanese tech giant said it would develop its 3D memory products faster and develop storage memory-class products.

As part of its reconstruction plan, Toshiba is selling its medical systems division (Toshiba Medical Equipment Systems) for 665 billion yen (£4.17bn) to Canon. It is also selling a majority interest in its home appliance business (Toshiba Lifestyle Products & Services) to China's Midea Group. The PC business has been slimmed down with a retrenchment to business-to-business sales outside Japan and a 1,300 staff reduction.

The total number of Toshiba group employees was 217,000 at the end of its fiscal 2014; 202,000 at the end of fy2015; and will be 183,000 at the end of fy2016. Executives and managers face bonus and salary reductions, with the execs getting no bonuses.

The company will focus on three platform businesses: Storage, Infrastructure and Energy (generation, transmission and distribution). The theme of the Storage platform is that it sustains the advanced information society. Its business unit is a Storage and Electronic Devices Solutions Company.

The core business of storage is memory (SSD and NAND chips), not disk, and memory products will be sold into the data centre, power generation, transportation, automotive, sensing, industry and mobile markets.

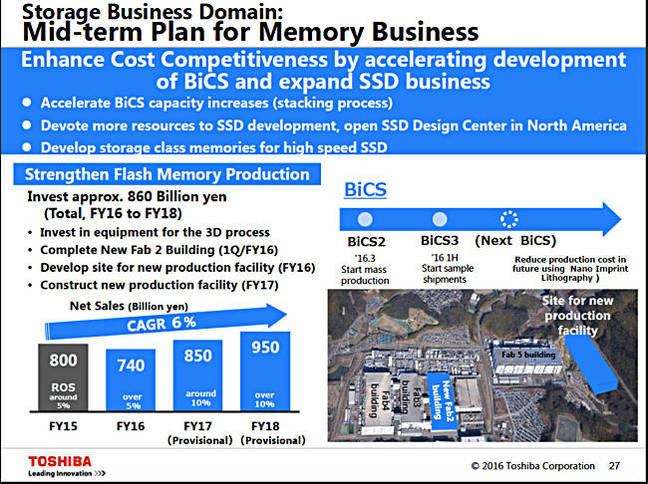

Tosh's storage business revenue plan looks like this:

- Fy 2015 - 1.56 trillion yen (memory: 800 billion yen) with a loss of -57 billion yen

- Fy 2016 - 1.43 trillion yen (memory: 740 billion yen) with a loss of -32 billion yen

- Fy 2018 - 1.68 trillion yen (memory: 950 billion yen) with a provisional profit.

HDD

In the disk drive area it will expand its line-up of enterprise and nearline products, with a planned 30 per cent rise in sales revenue this year compared to fy2015.

Stifel MD Aaron Rakers says Toshiba has increased its HDD operation headcount reduction from 150 to 450 people. The company “shipped ~7.13M enterprise HDDs in calendar 2015; ~2.3 million nearline HDDs but only 500,000 5TB + 6TB HDDs, or only 1.4 per cent of the industry’s >5TB capacity shipped,” a tiny amount.

Toshiba Canvio for Desktop drive

Tosh has updated its Canvio-branded external drives. A 3.5-inch Canvio for Desktop model follows on from the Canvio Desk and stores up to 2, 3, 4, 5 or 6 TB, with a USB 3.0 connector. Pre-loaded software provides customisable backup options. Canvio Premium drives are portable (2.5-inch) drives with up to 3TB capacity and USB Type-C connectors. They come with silver and dark grey metallic finishes, a soft carrying pouch, and remote access software.

Canvio Premium portable drives

3D NAND

Toshiba will accelerate its 3D capacity development and increase its production capacity.

The BiCS 3D NAND technology will see mass production of BiCS 2 (48-layer) in the third quarter of this year with sampling of BiCS 3 in the first half. A fourth BiCS development is planned after that. NAND production costs are going to be reduced through the use of Nano Imprint Lithography.

Toshiba Flash fabrication facilities

Currently Toshiba has Fabs 1, 2, 3 and 4 at its Yokkaichi facility in Japan’s Mie Prefecture, with a Fab 5 being built. Fab 2 redevelopment is nearing completion, planned for this quarter, and a Fab 6 site has been identified for a future production facility.

Rakers says: “Toshiba owns and is funding the construction of the New Fab 2, while SanDisk is committed to 50 per cent of the start-up costs, as well as 50 per cent of the initial ramp. SanDisk’s commitment for initial equipment and start-up costs is estimated to be ~$600m to be incurred through 2016.” The implication is that WD is aware of this and has reassured Toshiba that a WD-owned SanDisk will continue this relationship and funding. ®