This article is more than 1 year old

Goodbye: XPoint is Intel's best exit from NAND production hell

How a $35m revenue hit turns into a $167m profit change

Analysis 3D XPoint memory represents a door way to non-volatile profits for Intel and a passage away from NAND production, which is bedevilled by over-supply from costly fabrication plants with high costs.

This idea starts from a simple question: how is Intel’s flash business doing? Not well, according to a financial analyst.

In its first quarter results Intel separated out its Non-Volatile Memory Solutions business for the first time, which means NAND flash and 3D XPoint.

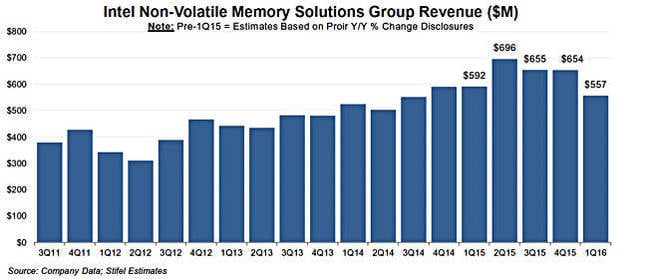

NVMS brought in $557m, which was six per cent down on the year-ago quarter’s $592.5m and 15 per cent less than the previous quarter’s $655.3m.

We can expect a Q4 to Q1 transition to reflect seasonally higher Q4 revenues but the annual decline can’t be similarly explained away.

The NVMS business made a $95m operating loss which compares to its profits of $72m a year ago. So, a $35.5m revenue decrease contributed to a $167m change in operating profit.

How so?

Analyst haus Stifel Nicolaus' MD, Aaron Rakers, notes:

- Pricing difficulties

- Potential cost difficulties as Intel MLC (2bits/cell) Planar NAND products competed with TLC (3bits/cell) NAND products from competitors

- Cost of 3D XPoint investment

- Cost of 3D NAND fab in Dalian, China

Looking ahead he points out the WD’s HGST unit sells SSDS jointly developed with Intel. Consequent on WD buying SanDisk, with its own NAND chip production facilities, this deal can be expected to close, removing a sales channel from Intel.

He estimates WD/HGST’s purchase of NAND flash from Intel as being 20-25 per cent of Intel’s current total NAND flash revenue. Having that go away will be a blow. That will exert downward pressure on Intel NAND revenues.

Considering a Stifel Nicolaus chart showing actual and calculated Intel flash revenues since the latter part of 2011, we can see growth to $696m in the second 2015 quarter from which peak revenues have since fallen.

Overall Intel revenue in the latest quarter was $13.7bn, so flash revenues represent 4.1 per cent of that total; relative trivia.

The long haul of NAND production

The only way Intel is going to make money from non-volatile memories is, in NAND, with 3D chip volume and costs being low enough to withstand pricing pressure, and, in XPoint, with controlled supply keeping prices high.

In NAND Intel and fab partner Micron are competing with WD/SanDisk-Toshiba (shared fabs), Samsung (industry leader) and SK hynix. The NAND market generally is over-supplied considering the costs of production. Suppliers are engaged in an ongoing race to make their flash bits cheaper than anyone else while giving them sufficient performance and endurance.

The planar-to-3D NAND transition is opening up some opportunities, and Intel-Micron claim they can make physically smaller 3D NAND chips than the others but are late to the market compared to Samsung and it will take many quarters to see if the claim is relevant and gets them more business.

XPoint supply points

XPoint is much more promising. No other supplier appears to have a working Resistive RAM/Phase-Change Memory technology that is sampling and matches XPoint’s performance and endurance capabilities. Micron and Intel should be able to match XPoint chip volume production to demand; meaning no over-supply.

For server and array controllers, along with workstations and gaming consoles, to take advantage of XPoint requires changes in system-level software – meaning Linux and Windows, for example – and ways for application software to make best use of XPoint SSDs and DIMMs, meaning they will get the claimed performance benefits and blow away competing hardware which doesn’t use XPoint.

Intel and Micron are helping this up-stack set of changes to take place.

Naturally Samsung, SanDisk/Toshiba and SK Hynix are all scrabbling to get their own non-volatile technologies that can compete with XPoint but they could be two to five years behind, giving Intel, and Micron, a one to four year window within which to sell XPoint to a market which should lap it up, subject to the pricing being right.

Basically, if XPoint succeeds, Intel’s NVMS group will make a bundle of cash. If it doesn’t then INtel's NVMS is in the multi-year hell that is NAND production and pricing. Intel, or Micron, may well decide to try and buy SK Hynix before Samsung or WD-SanDisk-Toshiba does, and so gain manufacturing volume. ®