This article is more than 1 year old

Israeli upstart E8 reckons it's hit storage's Holy Grail. Hmm

DSSD competitor squares up for market struggle

Israeli startup E8 has launched its rack-scale NVMe over Fabrics E8-D24 array at the Flash Memory Summit, saying it has the storage array Holy Grail, setting up a direct competition with EMC’s DSSD product.

The Holy Grail is a trifecta of high performance, low cost, and high availability. E8 says its customers get to overcome chronic storage-industry compromises.

Its array is aimed at real-time market data analytics, hyper-scale data centres fast block storage, high-performance computing, and SQL and NoSQL database applications.

IDC's research director for storage, Eric Burgener, talks of it completely changing the infrastructure density and cost equations. IT delivers “throughput and latency on par with hyper-converged offerings while bringing to bear all the efficiency benefits of shared, disaggregated storage.”

Some speeds and feeds, courtesy of E8's marketing material:

- 70TB in a 2U rack unit available this year and 140TB next year

- Field serviceable and upgradable 2.5” NVMe SSDs

- Supports converged Ethernet networking and optimised for 40/50/100 GbitE networks

- High availability with by dual controller boards, a no single point of failure enclosure and dual-parity RAID6

- Dynamic LUN and thin provisioning

- Network quality of service

- Designed for tier-1, high duty cycle usage, supporting non-disruptive software and hardware upgrades and battery backup

- Scalable to more than 100 servers per rack

We think the 70TB and 140TB numbers represent usable capacity.

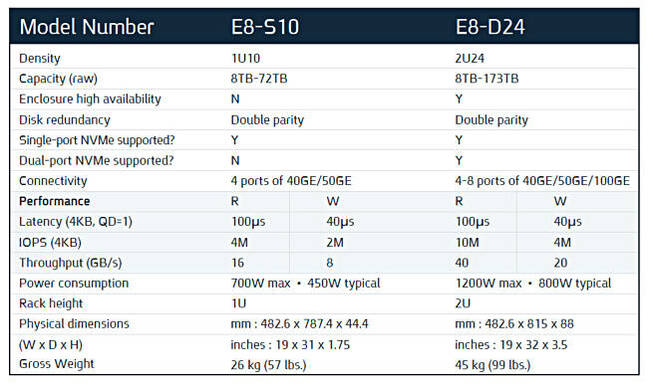

E8 product brochure table showing two products: 1U S10 and 2U D24.

A table from an E8 product brief shows two array products; the S10 and the D24. The D24 has 24 drives with a maximum of 173TB raw capacity, meaning 7.2TB SSDs are being used. The 72TB S10 would also use 7.2TB drives, ten of them. This doesn’t immediately square with the “70TB available now and 140TB next year” message.

However, the document text says that the D24 has from 6.4 to 141TB usable capacity so that equates to the 140TB D24 coming next year. Our understanding then is that the current D24 has 70TB usable capacity, 86.5TB raw capacity, and uses 3.6TB SSDs. E8 will use 7.2TB SSDS next year to get the 141TB usable capacity out of the available 173TB raw.

E8 says the array provides up to 88 per cent capacity utilisation of the NVMe SSDs inside it.

E8’s array

The company says its D24 array provides 10 times the performance of other all-flash arrays, and features fast random-access latency that guarantees consistent application availability and overall response times without any need for caching. Specifically, it says that it is the highest performing storage appliance based on commodity hardware ever to hit the market.

How does the D24 match EMC’s DSSD’ D5 product, with its proprietary flash modules? EMC claims 10 million IOPS for the D5, 155TB of capacity in 5U, average latency as low as 100μs, and throughput as high as 100 GB/sec. What does E8 say the D24 can do?

| E8-D24 | Read | Write |

|---|---|---|

| Latency (4KB, QD=1) | 100µs | 40µs |

| IOPS (4KB) | 10 million | 4 million |

| Throughput (GB/sec) | 40 | 20 |

So the D5 and D24 are in the same general performance area for IOPS and latency but the DSSD box has up to 100GB/sec throughput while E8’s D24 tops out at 40GB/sec.

Apeiron’s ADS1000, an NVMe SSD-using but hardware-assisted Ethernet fabric-linked array, delivers a claimed less than 100µs latency, up to 17.8 million IOPS and up to 152TB of raw capacity.

Mangstor’s 2U NX6320 offers up to 32TB of flash, 110µs read latency and 30µs write latency, up to 12/9GB/sec read/write sequential bandwidth and up to three million IOPS.

EMC is raising channel and customer awareness of its DSSD D5 capabilities as fast as it can. E8 now has to get its marketing and channel spears pointed in the right direction and used forcefully enough to raise its profile and build on its beta tests to establish a beach head in the market.

Apeiron, DSSD, E8 and Mangstor are leading the charge with NVMe flash arrays that have no network access latency penalty. Excelereo and Pavilion Data Systems are two startups following them, and Kaminario and Tegile are two established players with NVMeF technology on their roadmaps. This is, we think, how all high-performance external arrays will be accessed in the future.

The E8-D24 will be generally available in the fourth quarter of this year. ®