This article is more than 1 year old

White-box slingers, Chinese server makers now neck-and-neck with US tech giants

Jade kingdom has massive home advantage

Analysis An analyst poring over IDC’s fourth 2016 quarter server stats has found that Cisco is slipping, and white-box manufacturers and China-based vendors are overtaking the historically dominant US server suppliers.

Here is a server shipment market share snapshot in the fourth 2016 quarter using IDC numbers:

- Dell – 21 per cent.

- HPE – 20.3 per cent.

- Lenovo – 8.6 per cent.

- Cisco – 3.3 per cent.

- Others – 46.8 per cent.

Stifel analyst and managing director Aaron Rakers sees a current decline in server shipments due to “a pause in demand ahead of Intel’s Skylake Purley refresh in 2H2017.” There is underlying growth in the server market though, driven by non-traditional server vendors.

He says in 2016 IDC data showed the following year-on-year changes in server vendor shipment shares:

- HPE down 12 per cent.

- Dell down 2 per cent.

- IBM/Lenovo down 6 per cent.

- All other vendors (ex-HPE, Dell, and IBM/Lenovo) up 5 per cent.

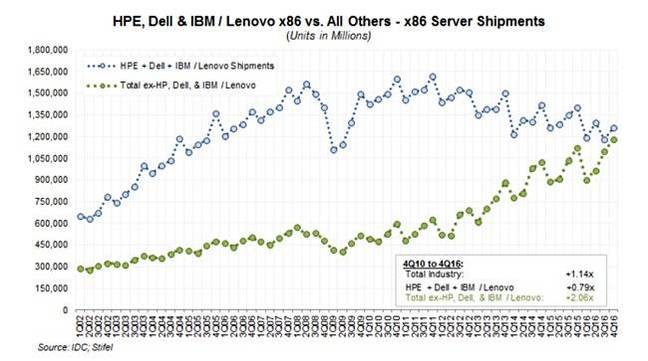

He estimates that Chinese server suppliers Huawei, Inspur, and Sugon server shipments were growing 44 per cent, 20 per cent, and 11 per cent respectively over the same timeframe, and charted the IDC historical numbers to show a surging ODM and Chinese server vendor market share rise over many quarters:

What Rakers has done here is graph a line showing HPE, Dell and IBM/Lenovo server shipments and a second line showing the total server shipment numbers, minus HPE, Dell and IBM/Lenovo. This enables us to see how the big three have been steadily losing market share since the fourth 2011 quarter, and they have lost share while the collective other suppliers – this means white boxers such as Quanta and the three big Chinese vendors Huawei, Inspur and Sugon – have gained it.

Unfortunately we don’t have access to the numbers which would show how China’s big three – Huawei, Inspur and Sugon – are doing as a trio versus the ODM/hyperscale suppliers from Taiwan.

Rakers suggests we should pay attention to:

- China’s increasing relevance in the overall server market.

- Workload migration to the public cloud.

- Ongoing adoption of software-defined data center (software-defined storage, NFV, etc) driving strong demand for tier-2/3 and ODM vendors.

He expects the third trend to continue to increase going forward.

Rakers notes that, for Cisco, “IDC data notes that Blade accounted for approximately 62 per cent of the company’s total trailing 12-month shipments, down from 65 per cent a year ago. The company’s blade server shipments during the December quarter declined 9.8 per cent y/y, while rack servers decreased 3.7 per cent y/y. The company now has a 1.9 per cent share in rack servers, down slightly from 2 per cent a year ago.”

This implies that Cisco has not focussed enough on rack server product business, being too wedded to its blade server form factor.

Reg comment

Are the trends shown in the chart above reversible? If volume manufacturing is the key to lower costs then no, they are not, and Cisco, Dell and HPE face a steady and relentless erosion of their market share.

Perhaps they should embrace the idea of downwards vertical integration and try to buy Quanta. After all, Seagate and Western Digital own their disk drive supply chain with component plants all over the Far East. If this works for US disk drive vendors then why not for US server vendors?

Lastly, it is strange that China-based Lenovo saw a fall in its shipment share. Possibly this was because its acquired IBM x86 server business is geographically strong outside China, and Lenovo has not been able to grow its revenues in China enough or to ship servers to hyperscale customers enough to compensate for declines elsewhere. ®