This article is more than 1 year old

China's phone quartet is shouldering its way into Western markets

Huawei breathing creepily down Apple's neck

Huawei is breathing over Apple's shoulder as Chinese brands make inroads into Western smartphone markets.

But it's also a testament to China's regional economic policy as it reaps the rewards of selling into emerging economies that neighbour the mainland, Gartner's Anshul Gupta told us.

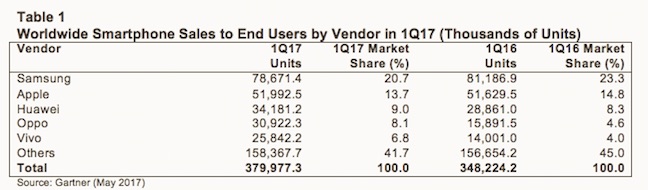

In Gartner's latest quarterly survey Samsung retained top spot with 78.6 million units sold to end users, and hangs on to 20.7 per cent market share – both declines on a year ago. Apple remains where it was with 51.9 million units sold, and 13.7 per cent share. However, the real growth is coming from the main three Chinese vendors – Huawei, Oppo and Vivo.

Huawei grew 8.3 per cent to retain third spot with 34.1 million units shipped, while Oppo (30.9 million) and Vivo (25.8 million) are breaking from the pack of also-rans. That includes former market leaders such as Sony, LG and HTC. If you added up Huawei, Oppo and Vivo, they'd be the biggest vendor.

"Markets such as India, Indonesia and Thailand, along with smaller markets like Sri Lanka and Vietnam, are showing good growth," says Gupta. "There the market penetration of smartphones is still low at 50 per cent, so there's upside growth".

The former leaders were unable to compete well at the lower end, Gupta added. "When competition from global players diminished you were left with local players which were not that great. But in the past 18-20 months Chinese brands have moved into many markets outside China. Vivo, Oppo, Huawei and Xioami are benefitting: all offer good quality and very competitive."

In India, Vivo grew by 220 per cent.

"They're like global brands, they're very comparable to devices that come from global brands. The devices all have the gold finish, the unibody structure, the lightweight frame and the use of chrome [the metal finish, not the browser]," Gupta said.

He predicts that these lesser-known Chinese brands will move into Europe as soon as they have resolved their intellectual property issues.

Higher prices

The eye-watering prices of recent flagships is reflected across the board, Gupta notes. Gartner has been watching the move to higher average selling prices for a while.

"The trend we are seeing in all markets is that people are spending more money providing they are getting a better experience. Rather than choosing the most affordable ones."

That's true across the mid tier and low end. There's very little round the £100 SIM-free price today.

Android overall increased its share of the duopoly by 2 per cent, to 86.1 per cent in Q1. Apple's iOS takes 13.7 per cent, and "others" just 0.2 per cent.

Here are the numbers from Q4 2016 analysed for you. ®