This article is more than 1 year old

China may stick to its own DRAM memory soon – researchers

NAND thanks for memory, folks... we don't need you any more

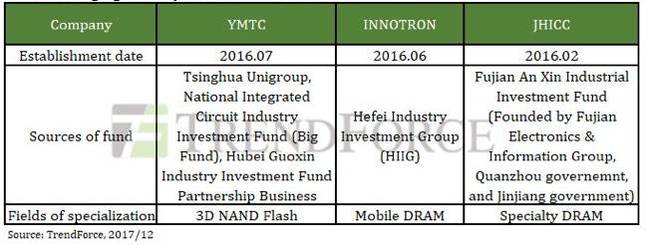

Industry researchers have reported that three players in China are currently building flash and memory fabs and appear to be working to make China self-sufficient in NAND and DRAM.

A TrendForce report titled "Breakdown Analysis of China's Semiconductor Industry", explains these players are backed by industry and state funds. It added that the fab-building initiatives had been set up after 2013-2015 era attempts to buy or buy into US semi-conductor companies failed. For example, Tsinghua Unigroup made a bid for Micron in 2015.

TrendForce tabulated summary of the three Chinese fab groups

Tsinghua Unigroup subsidiary YMTC (Yangtze Memory Technologies Company) is focusing on 3D NAND. It will first develop low-end products such as memory cards and USB drives; its technology is not yet competitive with established global suppliers in the SSD market according to the researchers. When its layering tech reaches the 64- and 96-layer levels, it is predicted to enter the SSD market.

YMTC is building a flash fab site in the Wuhan Donghu New Technology Development Zone. Currently XMC is trialling NAND fabbing in China but it will switch to NOR Flash, leaving 3D NAND a YMTC preserve.

Innotron is building a mobile DRAM capability. The TrendForcers say this is a fiercely competitive market, focusing on low power consumption. With China brands accounting for over 40 per cent of global smartphone shipments, Innotron could thus make headway with LPDDR4 memory, helped by Chinese government subsidies and supportive policies.

JHICC is making speciality DRAM for the consumer electronics market. It is expected to increase its production facilities, again with government subsidy help, and could enter the international market next year.

This trio of indigenous DRAM and NAND suppliers would have to meet and beat international competition to succeed. If this happens in the next three to five years, then Samsung, SK Hynix, Toshiba/WDC, Micron/Intel and others will lose revenue share in these markets and face significant market share loss in China.

+RegComment

We wonder if domestic American DRAM and NAND suppliers might start international fair trade spats if these Chinese suppliers entered the US market. Boeing, for example, was most belligerent over Bombardier competition in the airline industry and was backed by national trade regulators, which slapped import duties onto the Bombardier product. ®