This article is more than 1 year old

The hounds of storage track converged and hyperconverged beasts

Sniff... sniff. They can't be far. These animals just ate 1.96 EB!

Comment Tech market researcher IDC's Worldwide Quarterly Converged Systems Tracker has found that worldwide converged systems market revenue increased 10.8 per cent year over year to $2.99bn during the third quarter of 2017 (3Q17) – and that the market inhaled a massive 1.96 EB of new storage capacity during the quarter, up 30 per cent on the year.

IDC splits this market into three sections: certified reference systems & integrated infrastructure, hyperconverged systems, and integrated platforms.

Certified reference systems are converged system architectures, such as the Cisco-NetApp FlexPod. Integrated infrastructure are these systems supplied pre-built and pre-tested, with Dell EMC's VxBlock being the classic example.

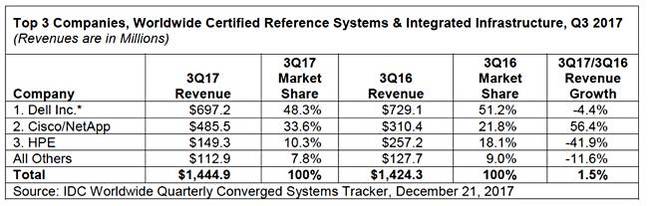

There were revenues of $l.44bn for the certified reference systems and integrated infrastructure segment in the quarter; IDC did not sub-divide the numbers for public consumption. This was a a year-over-year (y-on-y) increase of 1.5 per cent - flat really - and 48.3 per cent of the total converged systems market value.

Here's an IDC table listing the top three suppliers and the Others category:

It's obvious that the Integrated Infrastructure sub-segment saw falling revenues. The market leader in this category is Dell, with $697.2m in sales and a 48.3 per cent share.

That share declined 4.4 per cent y-on-y while second-placed Cisco/NetApp (meaning FlexPod) saw its share rise 56.4 per cent y-on-y to $485.5m.

Third-placed HPE saw a large fall in share of 41.09 per cent, down to $149.3m. It really does need to up its game here.

The others category had a pathetic 7.8 per cent share, down 11.6 per cent on the year, and showing that this is a game for the major players only.

Hyper-converged segment

Dell redeemed itself in the hyper-converged segment and then some;

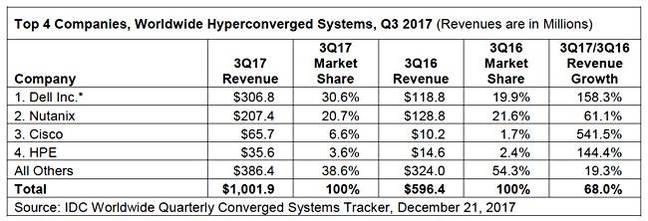

Hyper-converged systems sales grew 68.0 per cent y-on-y to $1bn, 33.5 per cent of the total converged systems market revenue.

Dell was top canine, with a 30.6 per cent share, having grown 158.3 per cent to $306.8mn in revenue y-o-y.

Second was Nutanix, market leader a year ago, with sales rising 61.1 per cent to $207.4m. However, IDC counts sales of OEMed Nutanix systems by Dell - the XC - products - as Dell sales, not Nutanix ones. This table doesn't provide Nutanix's overall revenues, which will obviously be higher than $207.4m, and so makes the top two market ranking slots debatable.

Cisco really pushed its Springpath-powered HyperFlex systems, raising revenues 541.5 per cent over the year, to third-placed $65.7m. It is growing from a small base and has a long way to go.

HPE also saw triple-digit growth of 144.4 per cent to $35.6m. Like Cisco, it's coming off a small base and has to drive hard if it has any hope of catching up the two leaders. The others category saw sales rise 19.3 per cent, much less than the market as a whole.

NetApp has only just entered this market and we'll be really, really interested in the next IDC Worldwide Quarterly Converged Systems Tracker, in March next year, to see how it has done, and what progress Cisco and HPE have made in preventing the hyper-converged marketing being completely dominated by Dell and Nutanix.

The Integrated platforms sector saw sales declined 19.8 per cent y-on-y to $542.7mn, 18.2 per cent of the total converged systems market value. Oracle was the top supplier, with revenues of $240.4mn and a 45.8 per cent share. Basically no change in position from the previous quarter.

The hyperconverged and converged reference architecture areas of the storage market are the hottest one of all, and now dominated by incumbent players, counting Nutanix as an incumbent.

We think Scale Computing is making progress in the hyperconverged area but would be surprised if many other players in the Others category outgrew the market. Do please tell us if we are wrong. ®