This article is more than 1 year old

Who was the storage dollar daddy in 2017? S. S. D

But disk shipped 10X more exabytes than flash

Customer spending on SSDs finally ruled the storage roost in 2017 but vendors still shipped more than ten times as much disk capacity as flash.

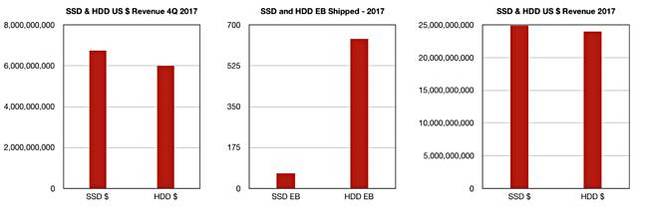

IDC numbers for the fourth 2017 quarter and full year, tweaked by Wells Fargo senior analyst Aaron Rakers, revealed the revenue crossover between the two tech types:

The crossover actually happened in the second 2017 quarter. Full year numbers look like this:

| 2017 | Y-on-Y Change | |

|---|---|---|

| SSD $ | $24,900,000,000 | 49% |

| HDD $ | $24,000,000,000 | -6% |

| SSD EB | 63.2 | 38% |

| HDD EB | 640.5 | 12% |

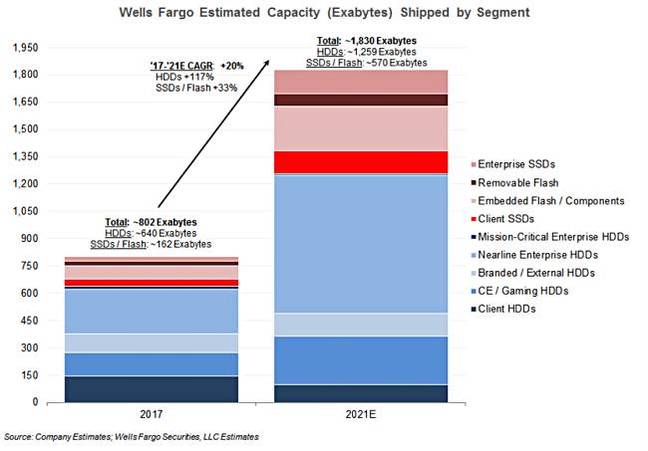

Rakers modelled the numbers to 2021 for both capacity and value:

The projection shows SSD capacity, at 802EB in 2021, is still less than half the HDD capacity shipped; 1,830EB.

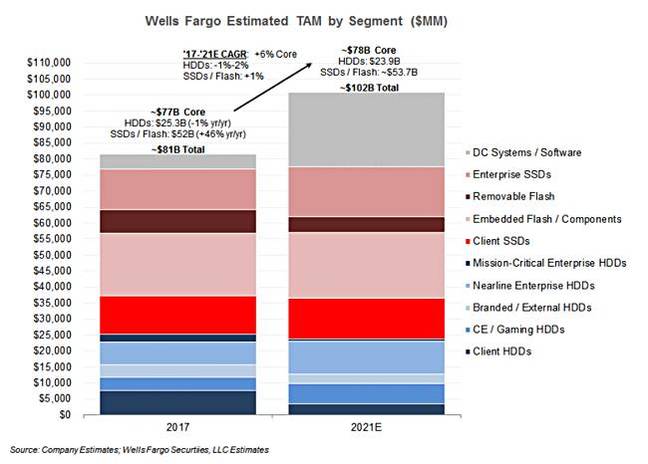

The value change chart:

This shows the total available SSD market growing at 1 per cent compound annual growth rate as the disk equivalent shrinks as -1 to -2 per cent but is still forecasted to be worth $23.9bn in 2021. Cheap, high-capacity flash isn't going to be nearly cheap enough to force any major nearline data move from disk to SSD.

TrendForce data shows NAND flash revenue rose by just 6.8 per cent quarter-on-quarter in 2017's fourth quarter, to $16.23bn. Here are the numbers by supplier:

| Company | 4Q 2017 $ | QonQ Change | 4Q 2017 Market Share | 3Q 2017 Market Share |

|---|---|---|---|---|

| Samsung | 6,196,6000,000 | 9.8% | 38.0% | 37.0% |

| Toshiba | 2,779,700,000 | 1.4% | 17.1% | 18.0% |

| WDC | 2,616,800,000 | 3.7% | 16.1% | 16.6% |

| Micron | 1,866,000,000 | 1.5% | 11.5% | 9.9% |

| SK Hynix | 1,797,500,000 | 19.5% | 11.1% | 9.9% |

| Intel | 889,000,000 | -0.2% | 5.5% | 5.9% |

| Others | 116,100,000 | 30.9% | 0.7% | 0.6% |

| Total | 16,234,600,000 | 6.8% | - | - |

Headline supplier points:

- Samsung's 4Q17 NAND flash bit shipments grew 10 per cent quarter-on-quarter on the back of demand from the smartphone and the server/data centre markets.

- SK Hynix posted a QoQ growth of 16 per cent related to the latest iPhone devices and flagship smartphones from Chinese brands.

- Toshiba's NAND flash bit shipments grew due to supplying memory products for new iPhone devices and PCIe SSDs.

The combined WDC and Toshiba share, at around $5.4bn, is not too far from Samsung's $6.2bn. The Intel-Micron duo's combined share of $2.75bn is a long way short of the Samsung level. ®