This article is more than 1 year old

Micron: We're pulling the plug on 3D XPoint. Anyone in the market for a Utah chip factory?

Intel's Gelsinger has a decision to make

Micron is stopping development of 3D XPoint technology and shifting resources into memory products that use the Compute Express Link (CXL).

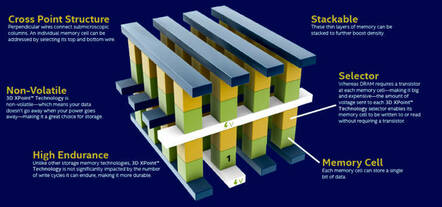

3D XPoint is the storage-class memory used in Intel's Optane brand SSDs and Persistent Memory (DIMM) products. CXL is an industry standard interface that enables flexible interconnection between compute, memory and storage devices.

Micron president and CEO Sanjay Mehrotra said in a statement: "Memory and storage are critical to the data economy, and the need for data centre memory innovation has never been greater.

"Today's announcement reflects our focus to invest in high-value solutions for customers that also deliver strong shareholder returns."

The company told the market last night: "Micron has now determined that there is insufficient market validation to justify the ongoing high levels of investments required to successfully commercialise 3D XPoint at scale to address the evolving memory and storage needs of its customers."

Micron manufactures 3D XPoint chips at its Lehi, Utah semiconductor foundry. These chips are then sold to Intel and are also being used in Micron’s own XPoint products, the QuantX X100 drives. Micron said it aims to sell this foundry, is in discussions with interested parties, and it intends to complete a sale agreement by the end of the year.

It said it plans to apply the knowledge it has gained from 3D XPoint to new types of memory-centric products that target the memory-storage hierarchy.

Wells Fargo senior analyst Aaron Rakers said of the tactic: "We applaud this strategic move."

He pointed out that Micron had recorded $545m in 3D XPoint and Lehi fab underutilisation charges for the combined past four quarters. Rakers said Micron believes that CPU-DRAM bandwidth has increasingly become a limiting factor of system performance, and that the CXL link can fix that.

Mehrotra himself pegged those underutilisation charges at the Lehi fab as having impacted "non-GAAP operating profits at an annual run rate of over $400m" in an investor update call last night.

On the same call, Micron’s EVP and chief business officer, Sumit Sadana, noted: "The value proposition of 3D XPoint was to operate as persistent memory at a lower cost to DRAM or as storage that is significantly faster than NAND.

"In the years since 3D XPoint was first announced, data center workloads and customer requirements have continued to evolve. As data-intensive workloads proliferate and AI ramps in data-centric applications, the CPU-DRAM bandwidth has become an increasingly limiting factor of overall system performance," said Sadana.

He added: "On the storage front, the significantly lower cost of NAND will remain a barrier for wide adoption of 3D XPoint. Therefore, 3D XPoint-based SSD products are not expected to be anything more than a niche market over time. Memory was always the strategic long term market opportunity for 3D XPoint."

We'll know more when the firm reports its fiscal second quarter earnings on March 31.

You know what's besides the XPoint, Intel? Somebody else's storage-class memory – SK Hynix

READ MOREMicron, clearly, believes investment in CXL memory products will produce a greater return than continuing XPoint development. And CXL memory devices will reduce the potential market size for XPoint, strengthening the argument for closing the XPoint project.

What this means

The immediate impact of this XPoint withdrawal by Micron is that Intel loses its XPoint manufacturing partner and has no long term guarantee of XPoint chip supply, unless the Lehi foundry sale is made with an ongoing XPoint manufacturing commitment.

A second impact is on the market perception of XPoint viability. Intel has struggled to build Optane SSD and DIMM sales and Micron has just declared it sees no way that Optane’s 3D XPoint technology can be successful in the market.

The possibility that Intel itself will withdraw from the 3D XPoint market has become stronger. Recently appointed CEO Pat Gelsinger now has a large decision to make: Should Intel continue its multi-billion dollar investment in Optane or use Micron's XPoint exit decision as a reason to pull its own plug on Optane?

Intel told newswires in a statement: "Micron's announcement doesn't change our strategy for Intel Optane or our ability to supply Intel Optane products to our customers."

XPoint history

Intel and Micron started 3D XPoint development in 2012, with Intel announcing the technology and its Optane brand in 2015, claiming it was 1,000 times faster than flash, with up to 1,000 times flash's endurance. That speed claim was not the case for block-addressable Optane SSDs, which used a PCIe interface. However bit-addressable Optane Persistent Memory (PMEM), which comes in a DIMM form factor, was much faster than SSDs but slower than DRAM. It is a form of storage-class memory, and required system and application software changes for its use.

These software changes were complex and Optane PMEM adoption has been slow, with Intel ploughing resources into building an ecosystem of enterprise software partners that support Optane PMEM.

Intel decided to make Optane PMEM a proprietary architecture with a closed link to specific Xeon CPUs. It has not made this CPU-Optane DIMM interconnect open and neither AMD, Arm nor any other CPU architectures can use it. Nor has Intel added CXL support to Optane.

The result is that, more than five years after its introduction, it is still not in wide scale use. ®