This article is more than 1 year old

Chromebook boom won’t outlive COVID-19 pandemic, says IDC

Tablets also flattened as punters resume spending on real-world fun

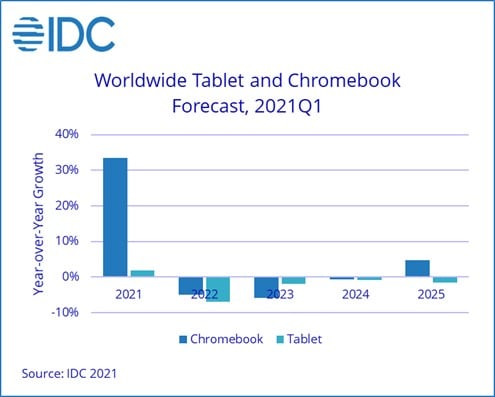

Chromebook sales will continue to boom in 2021, but as the COVID-19 pandemic recedes punters will decide they have more exciting ways to spend their money.

So says analyst firm IDC, in a forecast issued as part of its Worldwide Quarterly Personal Computing Device Tracker.

The analyst outfit predicts that Chromebook sales will surge by 33.5 per cent during 2021, with 43.4 million units rolling off production lines. Come 2022, and the firm predicts sales will go backwards. That’s quite a reversal compared to the 275 per cent growth rival analyst firm Canalys recorded for Chromebooks in 2020.

The outlook is worse for tablet devices. IDC forecast that while sales of those devices will grow by 1.8 per cent in 2021 — that’s well short of the double-digit growth recorded in 2020.

“Sales for tablets and Chromebooks greatly expanded in 2020 due to an unprecedented demand for remote working and learning solutions,” said Anuroopa Nataraj, an analyst in IDC’s Mobility and Consumer Device Trackers team, adding that demand for keenly priced and versatile devices suited to “hybrid working and learning” applications will remain high during 2021.

- Google bestows improved device management tools, authentication options on Chrome OS admins

- The kids are all right... for Google: Web giant talks up 40 new Chromebook models, school-focused ChromeOS

- Qualcomm hopes to attract devs to Windows 10 on Arm with new testbed, spins up 2nd-gen 7c cheapbook chips

Come 2022, however, punters will want to spend their hard-earned elsewhere.

“Beyond 2021 both categories will continue to struggle as consumer and education demand is expected to slow,” Nataraj wrote. “With the relaxation of lockdown restrictions, consumers will begin to increase spend on travel and other modes of entertainment, which in turn will impact growth in these devices.”

While Chromebook sales will slump, IDC says the devices have found a niche in “in job functions where high performance and legacy support isn’t a priority”.

The firm has predicted Chromebook sales will return to growth in 2025 but sees tablet sales ebbing for years to come. ®