This article is more than 1 year old

How US sanctions slugged Huawei and helped Apple top China's Q4 smartphone sales

Cupertino cut prices and cleaned up

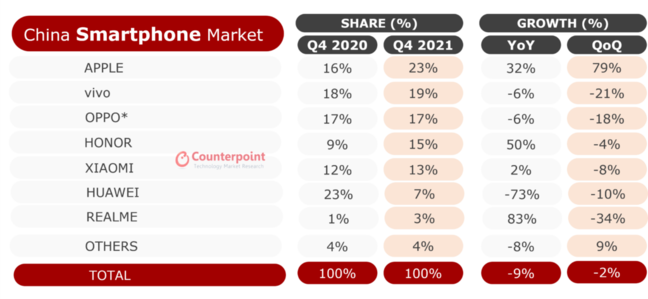

Huawei's share of China's smartphone market fell by 68 per cent year over year, and Apple took advantage to become the Middle Kingdom's most ubiquitous smartphone vendor in 2021's final quarter.

So says analyst firm Counterpoint, which on Wednesday published its Market Pulse for January 2022.

Apple's Q4 ascent saw it score an all-time high 23 per cent of the market. That figure was up 32 per cent year on year and 79 per cent quarter on quarter.

Huawei, on the other hand, had a horror Q4. It won just seven per cent of the market, compared to its 23 per cent market share in Q4 2020. That's a 73 per cent dip in Q4 2021 compared to Q4 2020.

Here is Counterpoint's look at the market for Q4 in 2020 and 2021.

"Apple's stellar performance was driven by a mix of its pricing strategy and gain from Huawei's premium base," said Counterpoint analyst Mengmeng Zhang. "The new iPhone 13 has led the success due to a relatively lower starting price at its release in China, as well as the new camera and 5G features. Furthermore, Huawei, Apple's main competitor in the premium market, faced declining sales due to the ongoing US sanctions."

By way of contrast, budget smartphone slinger Honor – which Huawei sold in November 2020 to a group exempt from US bans – grew its 2021 Q4 market market share by 50 per cent compared to its performance in 2020.

- Oppo joins the 'we designed our own chips' club, announces MariSilicon X

- Beijing wants to level up China's software industry, with an emphasis on FOSS

- Infosec chap: I found a way to hijack your web accounts, turn on your webcam from Safari – and Apple gave me $100k

- Indian government floats idea of home-grown challenger for Android and iOS

While Apple will be happy with its Q4 result, the quarter saw smartphone sales slip by nine per cent overall, and across all of 2021 shipments sagged by two per cent year over year.

Senior analyst Ivan Lam attributed the dip to supply chain issues, muted domestic spending, and lengthening smartphone replacement cycles.

"Smartphone designs within brands have also become more homogeneous, especially in hardware, failing to motivate consumers to upgrade," Lam observed.

Vivo ended 2021 as China's dominant vendor, holding 22 per cent of the market. Oppo was just one point further back, ahead of Apple's 16 per cent market share for the full year. Xiaomi scored 15 per cent, while Honor and Huawei each scored ten per cent market share. For Honor that was a six per cent annual jump, while for Huawei it represented a 68 per cent slump compared to sales for all of 2020. Ouch. ®