This article is more than 1 year old

VMware customers fear Broadcom acquisition will stall innovation, increase cost

Gartner advises renegotiating subscriptions now to avoid ‘dramatic’ and ‘extraordinary’ price rises

Analyst firms S&P Global Market Intelligence and Gartner have both offered negative evaluations of Broadcom's takeover of VMware.

S&P surveyed VMware customers and found 44 percent feel neutral about the deal, and 40 percent expressed negative sentiments.

But when the analyst crunched the numbers for current customers of both VMware and Broadcom, 56 percent expressed negative sentiments. More than a quarter rated their response to the deal as "extremely negative".

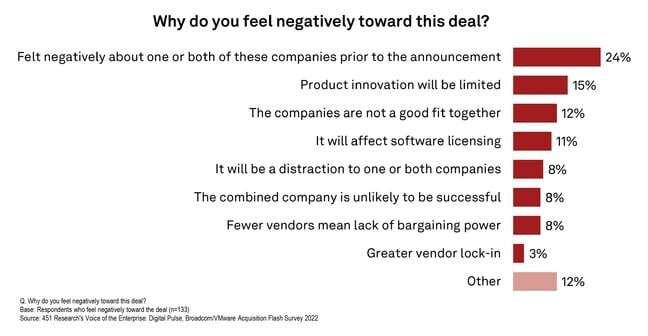

One reason S&P cited for that response was "potential impact on software licensing terms and conditions. Here's the analyst's list of other concerns raised by users:

Analyst group Gartner's thoughts on the deal focus on likely price rises, and how best to avoid them.

In a document titled "Quick Answer: How Should VMware Customers Prepare for the Broadcom Acquisition?" Gartner's analysts write: "After Broadcom's acquisitions of CA Technologies and Symantec, numerous customers complained to Gartner about dramatic out-the-door cost increases during renewals, with limited flexibility for negotiations."

The analyst group also sees "an influx of midsize and smaller customers looking to migrate away due to extraordinary price increases and challenges with support."

Gartner therefore suggests VMware customers should lock in long-term pricing with VMware before the Broadcom deal concludes.

"Adjust negotiating practices and mandate that VMware commit to specific provisions in writing before making large or strategic financial investments," the document advises, noting that it will be many months before the acquisition is complete.

"Negotiate exit clauses in new multiyear contracts," the document adds. "Negotiate price caps on subscription VMware license fees. Price caps should be within one percent to two percent of a standard metric such as the consumer price index."

Other advice calls for customers to secure commitments for delivery of technical enhancements for VMware products, especially code other than vSphere, NSX and vSAN.

- Cheers ransomware hits VMware ESXi systems

- Broadcom buying VMware could create an edge infrastructure and IoT empire

- VMware says server sprawl is back, and SmartNICs are the solution

And just in case Broadcom makes life intolerably miserable, Gartner recommends VMware users "Identify exit ramps for deployed products, including alternative solutions and migration activities."

Gartner also sees some upside in the acquisition, namely the possibility of:

- Improved co-engineering with Broadcom's existing portfolio, leading to product integration enhancements. Some potential examples include VMware Project Monterey with Broadcom's semiconductor business, Broadcom's ValueOps with Tanzu and a robust single-vendor SASE offering;

- Expected strong continued investment in the VSAN, NSX and vSphere products, as Broadcom seeks a focus on hybrid clouds;

- Improved breadth of technological resources of the combined entities to compete more effectively with AWS, Microsoft, Google and IBM/Red Hat.

S&P's research includes one user's opinion that Broadcom may be the ideal owner for VMware, because if other enterprise computing giants acquired the virtualization leader it would be hard to maintain the "Switzerland of cloud" status VMware covets.

Another Gartner prediction is that Broadcom may rationalize some products, as the artist formerly known as Symantec and VMware's Carbon Black unit both offer endpoint protection products, while CA sells and visibility and automation tools.

Gartner's advice nods to Broadcom's public statements that it focuses its attention on very large customers and trims R&D spend aimed at smaller users, and plans a rapid shift away from perpetual licenses for VMware products. Broadcom has also stated that it expects VMware to produce almost $4 billion more annual revenue by 2025 – considerably faster growth than the virtualization giant has achieved in recent years.

Broadcom execs have said the company plans to continue investment in core VMware products, and that it sees VMware's partner community as offering opportunities and possibilities it cannot currently address.

S&P's research also suggests Broadcom's remarks about the VMware channel signal the chip design firm won't apply the same tactics it used after buying CA and Symantec.

But Broadcom's previous price hikes and indifference to smaller customers are currently the most visible evidence of its approach acquisitions, leaving VMware customers The Register encountered nervous about the impact of the acquisition. ®